- Excel invoice template uk update#

- Excel invoice template uk registration#

- Excel invoice template uk download#

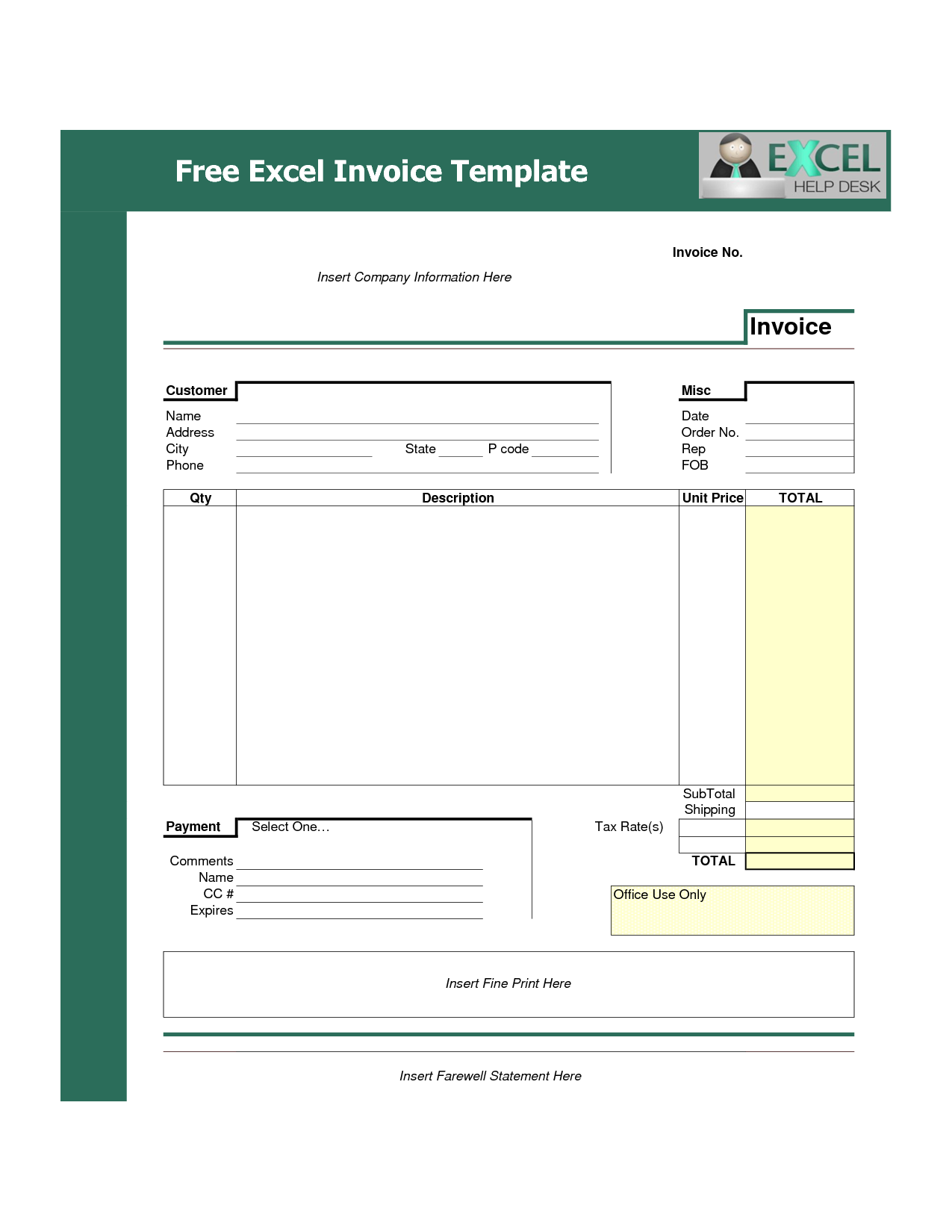

The Time of Supply cell automatically fetches the date of the invoice assuming that the invoice is issued along with the supply. In the case, the payment made in cash or against invoice then you need to delete the data in the cell. In addition to that this section on the right-hand side consists of Invoice number, Date, Time o Supply and Bill Due Date.īill due date is set for 30 days by default. Select the name of the supplier and it will automatically fetch details from the customer database sheet. The customer’s details section includes name, VAT number, address, phone number, email address, etc of your customer.

Excel invoice template uk registration#

It is mandatory to mention your VAT Registration Number on the invoice. The supplier’s section consists of your details like company name, company logo, company address, VAT number, invoice title as “VAT Invoice” etc. This Invoice Template consists of 4 sections: Supplier’s Details, Customer’s Details, Product Details, and Billing Summary and Other Details. Using the VLOOKUP function, when you select the customer name, the invoice automatically fetches all customer information on the invoice.

Excel invoice template uk update#

Update whenever a new customer is added to your business.ĭetails in the Customer Database sheet are used to create a dropdown list in the invoice template. You need to insert the details once in this sheet. The customer database consists of relevant details of customers like company name, address, contact details and VAT numbers, etc. UK VAT Multiple Tax Invoice template consists of 2 sheets: UK VAT Multiple Tax Invoice Template and Customer Database Sheet. Contents of UK VAT Multiple Tax Invoice Template Let us discuss the contents of the template in detail.

Excel invoice template uk download#

You can also download other VAT invoice templates for other countries like Simple UK VAT Invoice Template, Arabic VAT Invoice Template, GCC VAT Invoice Template With Discount and UAE VAT Payable Calculator, etc and much more from our website. Business units making mixed supply or supplies of goods or services or both can use this template to issue an invoice to their customers.Īll you need to do is just enter your company details in the heading section and start using it.Ĭlick here to download UK VAT Multiple Tax Invoice Excel Template.

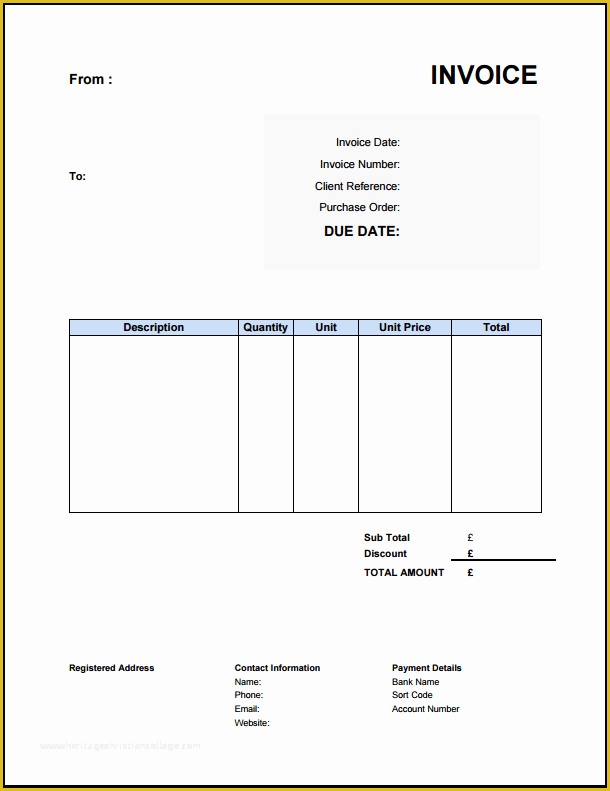

We have created the UK VAT Multiple Tax Invoice in Excel with predefined formulas and formatting. UK VAT Multiple Tax Invoice Excel Template Source: According to the second last guideline, the rate of VAT charged per item must be shown in case the VAT applicability is different on those items. Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items The tax point (or ‘time of supply’) if this is different from the invoice dateĬustomer’s name or trading name, and address Unique invoice number that follows on from the last invoice

After downloading the spreadsheet, you will find a settings tab, which will let you to do most of the customizations, like setting your company name, slogan and address, select the currency symbol, specific to your country of residence, right from within the drop-down list or even select the color of the invoice template from four pre-set colors. I have tried to make the sales invoice template as simple to use as I could, so that it can be customized in a matter of minutes, to help you save a lot of time that you could use to concentrate on other important aspects of running your enterprise.

0 kommentar(er)

0 kommentar(er)